Rocket VB is a breakout strategy with clear rules and strict risk control. It could be a valuable addition to your portfolio.

Inspiration

The Rocket VB strategy draws inspiration from dynamic breakout mechanisms that push prices above historical highs and applies additional strict volume conditions to avoid false signals. Its core idea is to capture the rapid upward move that often follows a consolidation phase and the breach of key resistance levels. Strategies of this kind rest on the observation that explosive breakouts frequently attract institutional investors, helping the move continue.

Key Components

Stockpicker Strategy

Entry through breaking the historical maximum

Breakout confirmation by volume

Precisely defined entry level using a Limit order

Universal exit rules, including SL, TP

Backtest 1, Fixed $ Money Management

As part of this test variant, a fixed amount of $100,000 was invested, divided proportionally into a maximum of 10 parallel positions.

Initial investment capital: $100,000

Testing period: 30 years

Date range: 1994 - 06.2025

Tested index: S&P500

Click the button to see the latest backtest:

Backtest 2, % Money Management

In this variant, 100% of the current capital was used in the strategy, which means that the value of the position changed proportionally to the account balance.

The equity chart for this test vs. the benchmark (SPY) looks as follows.

Basic statistics resulting from the test:

Trading Strategy Analysis

Net profit and CAGR

The Rocket VB strategy generated a net profit of $3,360,338, translating into a CAGR of 12.11%. The SPY benchmark reached $2,233,195 with a CAGR of 10.69%.

Drawdown and Return/Open Drawdown Ratio

The strategy recorded a Max Open Drawdown of -16.45%, resulting in a Return/Open Drawdown ratio of 7.81. In comparison, SPY achieved -55.19% and 5.2, respectively.

Exposure

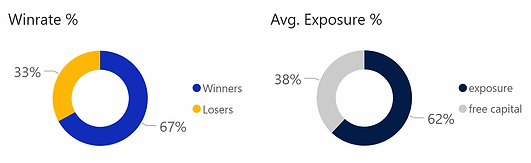

The average exposure of the strategy was 62.5%, indicating moderate capital engagement, leaving room for additional strategies in the portfolio.

Winning percent

The strategy achieved a win rate of 67%. This indicates high effectiveness while maintaining strict entry criteria. This is a very high win rate for breakout strategies. The payout ratio, i.e., average win/average loss, is 0.93.

SL & TP

The strategy uses both Stop Loss and Take Profit orders. They are precisely defined, allowing for effective risk and profit management at the level of individual transactions.

Market regime

The strategy has been tested in all basic market regimes and includes filters implemented on this basis. Read more about market regimes.

Trading costs

The tests included transaction costs and slippage, using data from the broker Alpaca. You can check our latest research on transaction costs using the Alpaca broker here. With a diversified stock portfolio and strategy, transaction costs can determine your profit or loss, so take the time to thoroughly test and choose a broker.

Robustness

The strategy has passed the parameter modification tests. A principle of minimizing the number of parameters was adopted to increase the strategy's robustness. The criteria for selecting parameters included their significant impact on effectiveness and alignment with the strategy's nature.

The robustness study of the strategy was conducted on stocks from the Russell 1000 and Nasdaq 100 indices, with a maximum number of open positions of 100 and 50, respectively. A total of 4,770 transactions were executed on the Russell 1000 and 515 transactions on the Nasdaq 100 as part of the tests. Capital management was applied in the %MM formula.

Recommended Instruments

The recommended primary instrument for this strategy on Algocloud Stockpicker is the S&P 500 index companies, which have shown the best historical results. However, the strategy also yields stable results on Nasdaq 100 stocks and Russell 1000.

Pattern Day Trader

The strategy over the examined period had only one transaction closed on the same day, thus it does not meet the criteria of a Pattern Day Trader (PDT) at all. This means that the strategy can be used without the requirement of maintaining a minimum balance of $25,000 in a real account and without restrictions on the number of transactions during the day.

Correlation

To check the correlation of the strategy with others, visit the correlations page.

Summary & Strengths and Weaknesses of the strategy

Strengths of the Strategy

Breakout profile - opposite to the reversal profile, which can be an important element in balancing a portfolio

High success rate providing comfort in use (Winrate 67%)

Rigorous entry conditions limiting false signals

The strategy works well on the S&P500, Nasdaq 100, Russell 1000 indices.

Weaknesses of the Strategy

Exposure at the level of 62% is relatively high and may limit the use of capital for other strategies.

Summary

The Rocket VB Strategy is a solid and interesting system based on strong breakout signals using technical analysis. By maintaining entry and exit discipline, it offers an effectiveness level of over 67% and attractive profit/risk parameters, making it a valuable tool in a balanced investment portfolio.

What you get in the package for this strategy:

Ebook describing detailed rules and results of the strategy.

SQX file ready to use on the Algocloud and StrategyQuant platforms.

Pseudocode that describes all the rules in an easy-to-understand way.

Disclaimer

The results obtained from historical data do not guarantee future outcomes. The effectiveness of a strategy can change over time. Backtesting is a tool that allows for the analysis and evaluation of an investment strategy based on historical data. Various factors, such as market changes or economic conditions, can influence the effectiveness of a strategy over time.

Investing always involves risk. This material is not investment advice. We share our experience and algorithms for educational purposes. We make efforts to ensure that our algorithms are error-free, but neither we nor the tools we use guarantee the absence of technical issues. Any decisions to use a particular strategy are made at your own risk and should be preceded by careful understanding and verification. You should always carefully consider your investment goals and risk tolerance before making investment decisions.

BEST STRATEGIES

Week Explorer Strategy

For last 40 years, the best day of the week on the US stock market has been Tuesday. The next day with the highest return is Wednesday. We present a strategy that skillfully exploits this market behavior by opening positions only on Mondays and cashing in profits in almost 70% of cases over the following days.

●

KO Christmas Rally Strategy

The seasonal holiday pattern on Coca-Cola is one fantastic example of how seasons affect stocks. The pattern has a logical justification, which is the association of the brand with holidays built over decades. This consequently influenced consumer and investor behavior before this period.